Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

Business Tax Return

Starts at $900.00

Includes:

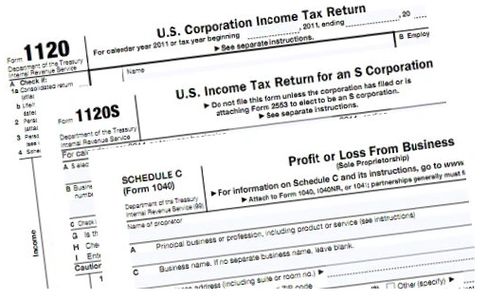

Form 1120S – US Income Tax Return for S-Corporation

Form 1120 – US C-Corporation Income Tax Return

Form 1065 - US Return for Partnership Income

Form 1040, Schedule C - Self Employed Income

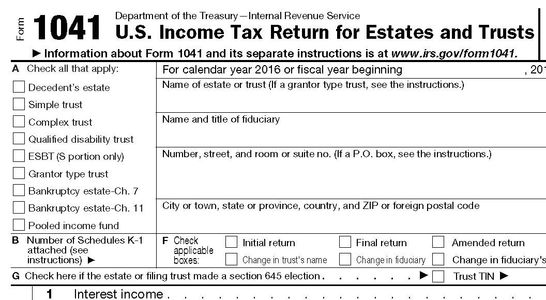

Form 1041 - US Income Tax Return for Estates and Trust

Starts at $900

Form 990-N - Electronic Notice (e-Postcard) for Tax exempt Organization

$95

Form 990EZ - Short Form: Return of Organization Exempt from Income Tax

Starts at $500

All other Form 990

Starts at $800

Paper-filed Tax Return

$100.00

Additional State

starts at $150 each

Extension Only $150

(will be credited to your tax prep fees

if you file the tax return with us.

This includes preparing and filing federal and 1 state return.

Issues K-1 to each shareholder or partner.

Addition filing requirement, will be additional costs.

Income verification may be required, this includes business bank statements, receipts or completed bookkeeping.

There will be additional bookkeeping charges if we prepare your books from receipts and bank statements

We may require proper documentations for other applicable credits and deductions.

Submit these documents in a timely manner so we can prepare and file your tax returns on-time.

All charges listed above are general fees for the services described. Our fees are intended to coincide with the expected time to perform the service. Your actual charges may be different due to complexity, outliers and unusual situations.

Call us today at 404-880-1628,

or send us an email to info@belnavisaccounting.com

You can also book your free consultation at a time that works for you.